RELIABLE BACKGROUND SCREENING NEWSLETTER – SEPTEMBER 2019

Prepare for Franchisee Screening Prior to Finalizing FDD

The Franchise Disclosure Document (FDD) is a federal requirement that franchisors must prepare in order to sell franchises. It is a document that requires disclosure to potential franchisees in every state, registration in some states, and filing in some other states. Many hours of time and legal fees are invested in its development.

One of the items that is determined during the FDD process is the franchise fee. Each franchisor has their own expectation for what their franchise fee should be. Unfortunately, too often one of the issues that is forgotten is the procedure for vetting a potential franchisee, specifically the franchisee background screening process and the components that it should comprise.

Proper franchisee background checks is one of the best investments for protecting the franchise brand. This is not only a benefit to the franchisor, but to each subsequent franchisee, who also is making an investment in that brand.

When properly structured, franchisee screening should cost the franchisor nothing, as the average fees associated with franchisee screening can either be added to the franchise fee, or simply disclosed in the FDD as a separate application fee or background check fee. Even though this paradigm passes the cost of franchisee screening onto the franchisee, it is truly a benefit to each successive franchisee, as they know that future franchisee owners will also be vetted, helping to exclude individuals whose backgrounds could pose a threat to the entire franchise brand.

What elements should be included in a proper “best practices” franchisee screening background check? Although there may be some variations based upon industry, typical features include:

- Credit report with a credit score

- Criminal database check, including the national sex offender registry, and various “watch lists” such as SDNs, OFAC, FBI Most Wanted, et.al.

- Federal Criminal Records Search on all names and legal aliases for past seven years

- County Criminal Records Search, on all legal names, aliases and addresses that are revealed for the past seven years

- Social Search/Social Trace product - to uncover the names, aliases and addresses of the individual for the past seven years

- Bankruptcy-Lien-Judgment Search on all names and aliases. This is particularly important, since tax liens and civil judgments have disappeared from all three credit bureaus ever since July 1, 2017.

Again, the cost of franchisee screening should be borne by the franchisee. However, this becomes possible only when the franchisor has been properly advised prior to creating their FDD. Hopefully this article will serve as the catalyst to all who advise franchisors.

Franchisors should either be counseled that the average franchisee screening cost for a thorough background check be added to their franchise fee, or have this expense simply disclosed in the FDD as a separate application fee or background check fee.

Rudy Troisi, L.P.I., President and CEO, Reliable Background Screening

BRETT’S RELIABLE QUICK TIPS

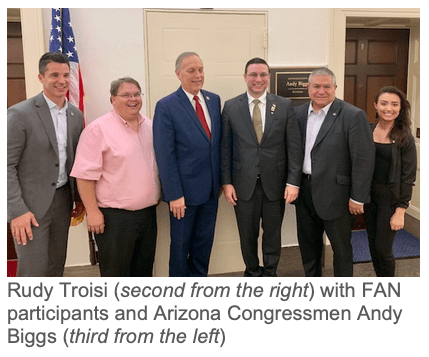

We Had a Great Time at the FAN Annual Meeting

Our very own Rudy Troisi attended the Franchise Action Network Annual Meeting September 09 – 11, 2019 in Washington, DC. There he met with government representatives in Congress to discuss legislation that impacts the franchise business model.

We Appreciate and Reward Referrals

To keep costs in check to provide our quality services at fair prices, we rely on our satisfied clients’ referrals to get new clients.

If you are happy with the service we are providing you, we will greatly appreciate you referring us to others like you who also value protecting their brand, reputation, and safety. As a token of our appreciation, we will send you a $25 Amazon gift card.

The Credit Bureau: Building the Clearinghouse of Credit History

Along with the ending of the Civil War and the beginning of the Wild West, the concept of credit bureaus can be traced back to the early 1860’s. The chief purpose was to provide local merchants with a way to keep tabs on the people who traded and did business in their immediate area.

The ‘Credit Bureau’ essentially consisted of a list of individuals who were poor credit risks. Prior to the use of a list, merchants extended only a very small amount of credit, and that was based only on the merchant’s personal knowledge.

In 1906, several of these credit reporting agencies came together to form the Associated Credit Bureaus, Inc. The Associated Credit Bureaus, Inc. represents credit bureaus before the Federal Trade Commission and state and federal legislators, protecting their interests.

Things really progressed after World War I (“The war to end all wars”), technology improved, the population became more mobile, creating a broader base of consumers, and more lending was needed! Needless to say, the credit industry began to take shape. The invaluable information provided by the early industry included employment records, information from landlords; and data in public records.

These days, although there are the “Big Three” credit reporting agencies: Equifax, TransUnion, and Experian, most companies that need to best mitigate risk will require more than just credit reports. These companies will use consumer reporting agencies (CRAs), such as Reliable Background Screening, to not only obtain a credit report, but to also gather information that credit reports no longer provide (such as most public records – tax liens and civil judgments), in addition to searching for criminal records, driving records, and verification of educational and professional credentials.